Dear friends,

Thanks for the question dated 15.3.2024. "What can be done to protect people from fraud"?

This question is asked broadly. However, for financial services, money (an invention of the Human) and fraud are exclusively his/her business.

In a holistic sense, it is a keyword of a third person (observer) in a systemic (complex) environment (e.g., in Great Triad, GT) that impacts a community of people (e.g., Self-Powered Communities, SPC) in three layers:

The first layer is philosophy, the interplay of science (in the sense of learning about processes, goals, and paths in them), politics (the convergence of individual selfishness and the need for mutual belonging), and religion (in the sense of changing the positions of individuals' inner worlds, their cultural roots and sustainable coexistence in the structures of human communities).

The second is a methodology for reaching a consensus about human philosophy, his position in As-Is time towards missions, and his position in To-Be time, including learning about processes (their verification, implementation, and acceptance). All this is motivated by demand and supply opportunities and guided by the results of good practice from the past.

The third is represented by processes, in the sense of progress (change), the path of steps, algorithms in organizations, projects, and communication caused by a third person (observer).

Their preparation and implementation take the form of three basic versions:

Documents, verbal or text messages, and calls of individuals to their surroundings through teams and collectives regarding activities (promoted or managed) in a specific space and time (e.g., cases of roles of leaders and their voters).

Models that supplement documents with a view of the reality of (described or investigated) procedures (plans) and are part of or enter into objects of a wider team or collective interest (e.g., in the balanced demands of the governance power and economy efficiency of the infrastructure service’s needs)

Systems: a set of principles or procedures (within a philosophy and with the support of models) according to which organizations work and prepare their projects. Concerning the project methodology (via project triad), it applies principles to small (partial) or large (complex) parts of a higher whole (e.g., the polarity of the governance and economy transformation to the projected SHIFT).

The answer to the "Question" is being formed for the GT environment and the SPC human communities, with an emphasis on transparency of thinking (philosophy) and on achieving consensus (methodology) to understand what is happening around us in the GT (it has a broader meaning than a traditional life-environment definition).

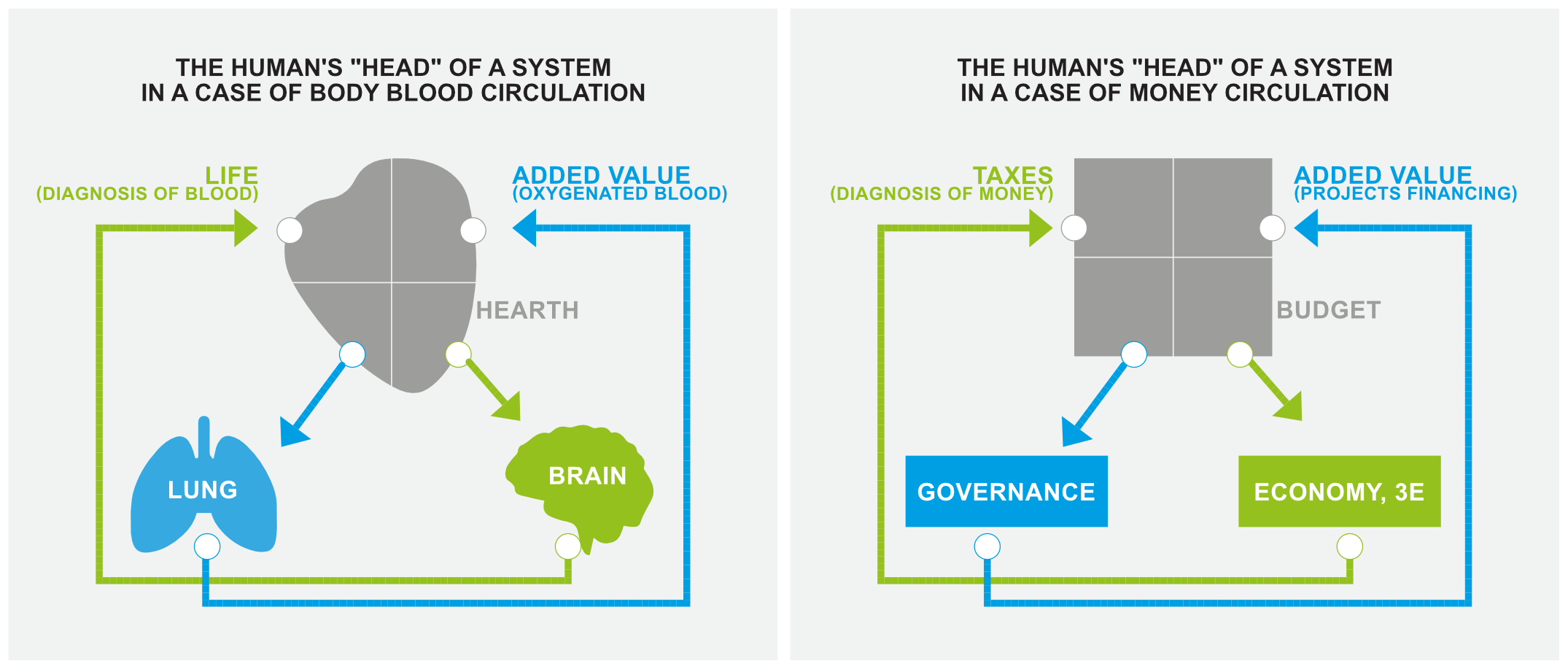

Figure 1 Examples of the perception of the philosophy and methodology of the processes around us.

Figure 2 An example of a holistic perception of two processes is the responsibility of Nature and the Human in the GT.

Figure 3 Examples of the perception of the word fraud in financial services for organizations, projects, and communication.

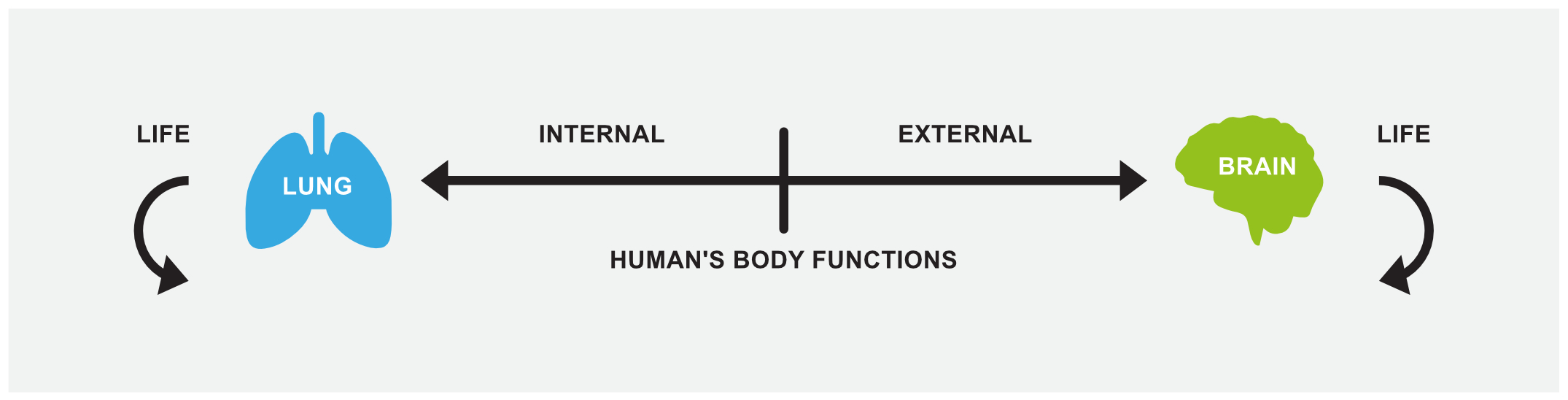

Figure 3a.

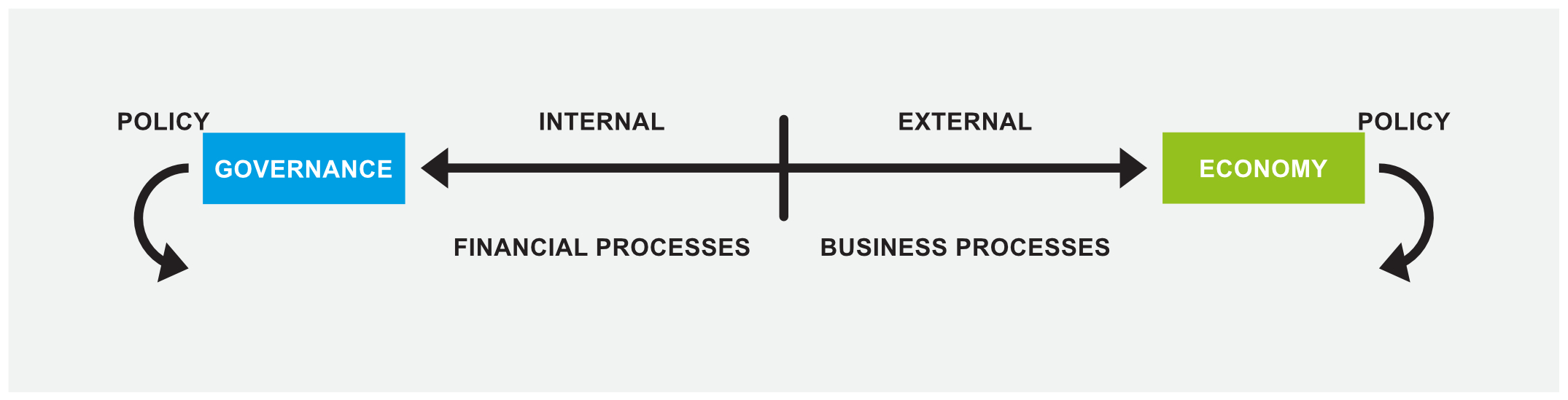

Figure 3b.

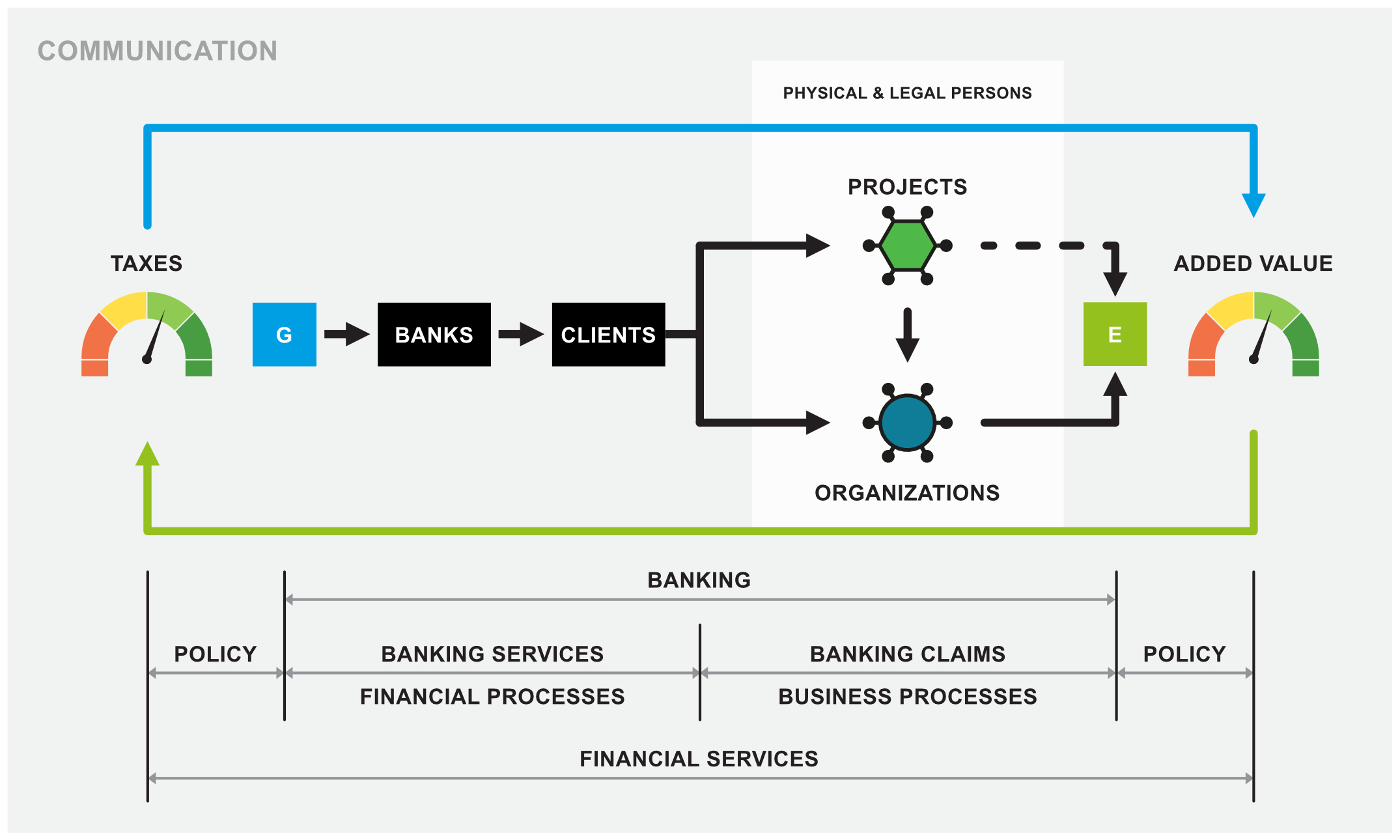

Figure 3c.

Comment to Figures:

The documents prepare the ground for communication, working with models, and giving direction and the necessary dimensions of the requested changes. A change is being prepared (SHIFT) in the GT environment (sustainability and continued development of humans with fatal respect for their partners, the Earth and Nature).

Figure 1 refers to the philosophy (fateful self-reflection) of each As-Is population's knowledge and moral potential, how to reach a consensus, and how to proceed. UN4WN's current activities are in the document creation phase; there is still a long way to go for the development of models (e.g., for the keyword froud). However, we are optimistic; the work is ahead (e.g., Self-Powered Community Concept).

Figure 2. offers an approach to modeling the "content" of a given question. It compares the circulation of blood (its role) in living organisms, specifically Man, with the circulation of money (financial role) in people's activities (in organizations, projects, and mutual communication). Both circulations (systems) have standard functions: to stabilize, develop, and manage the risks of destruction (burnout, aging). For example, comparisons between the prevention and treatment of the blood circulation system in the human body and the prevention and treatment of the money circulation system in the human community are on the table. The research object is proposed to be modeled to generate a source of inputs (data) for a future Governance and Economy System (e.g., by Figure 3 scheme).

Figure 3. offers more detail.

In part 3a. It says how the "Lungs" give strength (oxygen) to the blood, and the revived blood charges the "Brain" for the activities of the Human to manage (monitor) and control (check) his/her body and soul.

Part 3b. It puts another case in the same light. Governance and Economy, two activities under the full responsibility of the Human, is the research object. It models the need for the revival of money, mobility, and protection from damage in the internal and external environment. The "circulation of money" system manages the business policy risks of individuals, teams, and collectives in the human community (e.g., in the structure of low, middle, and high-income countries; LIC, MIC, or HIC).

Part 3c. has a direct link to the question posed. It defines the scope of financial services and the role of the area called banking.

It distinguishes three areas specific to the identification, assessment, and correction of fraud in financial processes:

Politics: self-expression of plausible inputs, influenced by emotions and the short-term and hard-to-predict content of input data presented generally, in unstructured time and with missing data on predicted costs. Tuning policy to reality requires democratic principles. Financial services must be preceded by the permanent care of the relationship between "leaders and voters" to their motivation and navigation for building financial trust (e.g., it is a specific agenda for the SPC environment).

Financial processes (technology content): offering a wide range of financial services (banks, credit unions, insurance companies, brokerage firms, etc.) in a technologically transparent environment (e.g., transnational financial transfers or local mobile money on hand). This space is suitable for SW Tamara-type applications. It is about fraud control (reduction) technologies in payments, savings, loans, and insurance (SW apps on running processes).

Business processes (financial content): a wide range of financial services for organizations (for production, services, work), for projects aimed at developing public and private sector organizations, and communication in the local and global space, and for services and development of public infrastructures. One SW cannot cover these business processes; the fraud risks are enormous. It falls into the management category (e.g., for businesses, corporations, or projects) and for individuals if they are in situations where they need to spend or invest their money (e.g., in LIC that comes to them via mobile without any froud). The froud risks are everywhere. Standards and process unification are indeed growing, and new technologies are entering, but the scope of process unification still needs to be expanded. The SPC Concept presents an idea of the New Project Paradigm (NPP) that is coming closer to these visions.

The answer to the question: "What can be done to protect people from fraud"?

Financial services are the right environment for recognizing (revealing) and quantifying the impacts and realizing the risks of selfishness in the ambitions of Human beings to establish their existence in the GT environment. Policy is an integral part of the financial service and deploying technology during the "leader-voter" session is the solution.

Technology is the engine of change; SW Tamara is developing promisingly, but it is still a SW that responds to processes. If you apply quality SW to bad (destructive), unconnected processes, the result will remain just as bad. A different environment creates entrepreneurship in organizations and projects (e.g., fraud risks when setting priorities for tying financial resources to development and security or public procurement risks). From this above, we can deduce that practical anti-fraud tools lie on three levels:

Philosophy: There is a common (societal) global perception of the role of money in people's lives (e.g., space in the UN4WN plane, which is why I participate in these activities).

Methodology: technology changes the style and rhythm of our world for better if we understand it and for worse if we underestimate or abuse it. Methodologies are the language of these changes.

Processes are reactions to the technologies we invent and use, and frauds are primary processes (ad hoc or pre-prepared). For me, only consistent internal financial control and timely audits apply to financial fraud.

Annex

Thanks for the prompt to check out the Tamara tool, a free, open-source software application for detecting fraud and money laundering (in real time). I am looking for suitable new technologies for the CPC Concept. I have already focused on the existence (availability) of Blockchain and Smart Contracts. Allow me to present to you the result of my research:

General description

The financial flow process exists and its modeling: in it the donors are, e.g., any International financial institution, private/public funds, etc, who send money (addressed to any object of Social and Economic Development (SED), Disaster Risks Reduction (DRR), or Humanitarian Aids HA). Financial users are presented as a structure of four levels:

The first is the LIC government (officials) and their policy role in the money allocation (shifting and collecting other money for spatial projects in a policy (data fuzzy) spectrum of responsibility).

The second is a public/private body (structured as organizations in a standard mode) and its policy-procurement role (in the sense of the first money allocation and the first data structure forming based on indicated, wanted projects).

The third is in a local investor's position (any wearer of a loan burden and risk) with responsibility for project preparation (project prospectus, financial plans, and the money spending completion) and procurement (project supply arrangement).

The fourth is data structure building, operations, and data sources for feedback needs.

Model simplification

It is about small, simple projects (access to water, electricity, food, jobs, services), their work packages, and milestones in a unified structure in an informal environment with minimal legal smog.

Model assumptions

In parallel, it is about the SPC utility and SPC Drivers service development and building in any province (about 1 million inhabitants) of LIC, worldwide with links to local universities, Local Governmental Units (LGUs), and Central governments (this the scope of the start-up of the potential of a future business).

My questions

How is it to see the blockchain's role in such a broad chain (in separate, per-partes building of sequences respecting the internal financial control operations and audit's responsibility)?

How do we grasp the Smart Contract role in the chain of projects' working packages and milestones (in a standard project management manner)? For "the stabilized project portfolio of each SPC Utility and a link to LGUs via the SPC Driver services (boundary conditions modeling).

The role of machine learning in shifting the personal responsibility of local participants (from politicians, leaders, and engineers to workers on a site) to a machine manner and the feedback of machines used as multifunctional education and testing tools.

The answer

Thank you for your detailed email. Kindly find the following response to your questions.

Blockchain technology offers a great opportunity to build sequences that respect internal financial control operations and audit responsibilities. Blockchain technology has indeed revolutionized various industries, including finance. In terms of its role in a broad chain, blockchain provides transparency, immutability, and decentralization. It allows for secure and efficient transactions while maintaining an auditable trail of activities. By leveraging smart contracts and distributed ledger technology, organizations can streamline their processes, enhance accountability, and minimize the risk of fraud.

The role of Smart Contracts in project management. Smart Contracts play a crucial role in the chain of projects' working packages and milestones, especially when it comes to ensuring transparency, efficiency, and automation in transactions. In a standard project management manner, Smart Contracts can help streamline processes by automatically executing predefined actions based on specific conditions.

Regarding each SPC Utility's stabilized project portfolio and its link to Local Government Units (LGUs) via the SPC Driver services (boundary conditions modeling), incorporating Smart Contracts can offer numerous benefits. These include secure and tamper-proof record-keeping, automated payment processing, real-time project milestone tracking, and improved stakeholder accountability.

We are passionate about exploring cutting-edge solutions in blockchain technology. While our expertise lies primarily in blockchain development, we understand the growing importance of machine learning and its potential impact across various industries.

We would love to hear more about your insights and discuss potential collaborations or projects that align with our areas of expertise. If you would like more detailed information or assistance implementing Smart Contracts within your project management framework, please contact our team at Antier Solutions at https://www.antiersolutions.com/metaverse-consulting-company/.